Reporters have revealed a massive collection of leaked documents showing how rich and powerful people around the world have been hiding their money and property “offshore” in order to avoid taxes. Many of the people are well-known world leaders.

The leak, which is being called the “Pandora Papers”, shows complicated webs of companies, set up in different countries, that help hide the owners of money and property.

(Source: Website screenshot, ICIJ.)

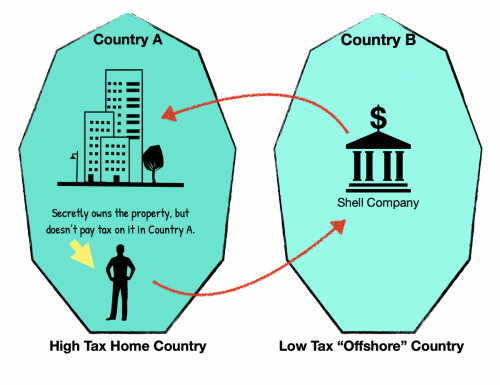

For example, a person might have property in one country, but use a fake company based in another country (“offshore”) to own it. Often, rather than a single company, there might be a chain of these “shell companies” that own the property.

The main reason offshore companies are used is to move money or property from a country with high tax rates to one with low tax rates. Places with low tax rates are often called “tax havens”. Tax havens also make it easy to start a company while keeping the owners secret.

(Source: NewsForKids.net [CC BY-SA 4.0]. Building: [CC0], svgsilh.com.)

The Pandora Papers include the secret records of a large group of well-known people from around the world. The list includes 35 national leaders and over 330 politicians from nearly 100 countries. It also includes billionaires, pop stars, and criminals.

The information was collected by a group of reporters known as the ICIJ (International Consortium of Investigative Journalists). Over 140 news agencies from 117 countries spent months studying the files, which were given to the ICIJ by an unnamed person.

The Pandora Papers include the secret records of a large group of well-known people from around the world. The list includes 35 national leaders and over 330 politicians from nearly 100 countries. The map below shows where the politicians were from.

😕

This graphic has not been loaded because of your cookie choices. To view the content, you can accept 'Non-necessary' cookies.

Experts believe that at least $11.3 trillion ($11,300,000,000,000) is held offshore, where it can’t be taxed. The ICIJ says that number could be as high as $32 trillion.

But when people avoid paying taxes, that means governments are missing out on money they could otherwise use on public services, like schools, roads, and health care. The International Monetary Fund says that, worldwide, governments lose up to $600 billion a year in taxes that don’t get paid because of tax havens.

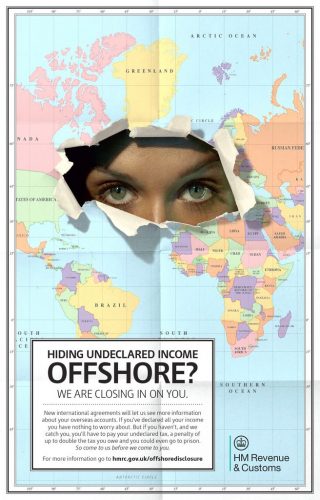

(Source: H.M. Revenue & Customs [CC BY 2.0], via Wikimedia Commons.)

It’s not actually against the law to use tax havens. Rich people can often find holes in the laws that allow them to legally move their money or property to offshore companies. But criminals also use offshore accounts to hide money they got illegally.

The Pandora Papers are being released at a time when many countries are talking about how they can work together to make sure tax systems are fair, and that people and organizations are paying the taxes they owe.

😕

This image has not been loaded because of your cookie choices. To view the content, you can accept 'Non-necessary' cookies.

The Pandora Papers have come out at a time when many countries are starting to work together to make sure tax systems are fair, and that people are paying the taxes they owe. Above, representatives of the G7 in June after agreeing to make tougher rules for tax havens.

Similar leaks, called the Panama Papers and the Paradise Papers, came out in 2016 and 2017. These leaks showed how rich people hid their money and avoided taxes. After those leaks, leaders promised to crack down on this kind of behavior.

The new leak shows that, five years later, things haven’t changed much. Several politicians named in the Pandora Papers came to power promising to crack down on people who hid their money offshore.

😕

This image has not been loaded because of your cookie choices. To view the content, you can accept 'Non-necessary' cookies.

Several politicians named in the Pandora Papers came to power promising to crack down on people who hid their money offshore. One example of this is Czech Prime Minister Andrej Babis, above, who was named in the leak.

Politicians have the power to make it harder for people to use offshore companies. But, as Gerard Ryle, who leads the ICIJ, points out, many politicians don’t want to change the laws, since they themselves are using tax havens.

Did You Know…?

Some of the best known tax havens include places like the British Virgin Islands, and countries like Switzerland and Singapore. But in recent years some unexpected places, such as South Dakota, have become tax havens, by changing their laws to make sure company owners can be kept secret.