A tariff is a special tax that is charged when something comes into a country. Tariffs can be used to protect businesses inside a country. They can also raise money for a government. In general, experts agree that tariffs don’t work very well.

An Example:

The US has tariffs on many items. For example, the US has a tariff of 11% on some kinds of bicycles. That means if a bicycle store in the US wants to bring a bike that costs $1,000 into the US from another country, the bike store would have to pay the US government $110. Since the bike store has now paid $1,110 for the bike, they will have to sell it for more than that in order to make money.

The idea behind tariffs is to make foreign things cost more so that people buy more things made inside the country.

But most people who study this kind of business say that that is not how things usually work. Usually, as the cost of foreign things go up, the cost of things made inside the country also goes up.

And even if the tariff helps businesses in one area, it can hurt others. For example, a bicycle tariff might help bike makers. But if fewer bikes are being sold in the country, it could hurt the people who make and sell other things, like bells, helmets, lights, and tires.

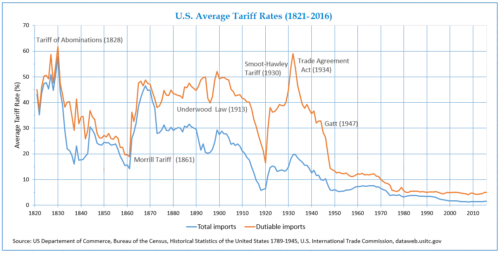

Since the end of World War II, US tariffs have been very low.

(Source: James 4, from Wikimedia Commons.)

For these reasons, tariffs can hurt everyone. Foreign countries don’t sell as much because there is a tariff. Businesses in the country may sell fewer things because the price has gone up. And the items simply cost more for the people in the country which has the tariff.